At Home Financing Center, we understand that securing a home loan can be an overwhelming experience. With numerous steps and considerations, it's essential to approach the process with a clear understanding. This step-by-step guide will simplify your journey to obtaining the financing you need for your dream home.

Navigating the Home Loan Process: A Step-by-Step Guide

Navigating the Home Loan Process: A Step-by-Step Guide

Step 1: Assess Your Financial Health

Before you start the home loan process, it's crucial to evaluate your financial situation. Check your credit score, review your income, and calculate your debt-to-income ratio. Understanding these factors will help you identify how much you can afford and what loan options may be available to you.

Step 2: Get Pre-Approved

Once you've assessed your finances, the next step is to get pre-approved for a mortgage. This process involves submitting your financial information to a lender, who will then determine how much you can borrow. Pre-approval streamlines your home search and gives you a competitive edge when making an offer.

Step 3: Shop for Lenders

With your pre-approval in hand, it's time to shop around for lenders. Compare interest rates, loan terms, and fees from different institutions. Don’t hesitate to ask questions about each lender’s offerings. Finding the right lender is crucial, as it can significantly impact your overall loan experience.

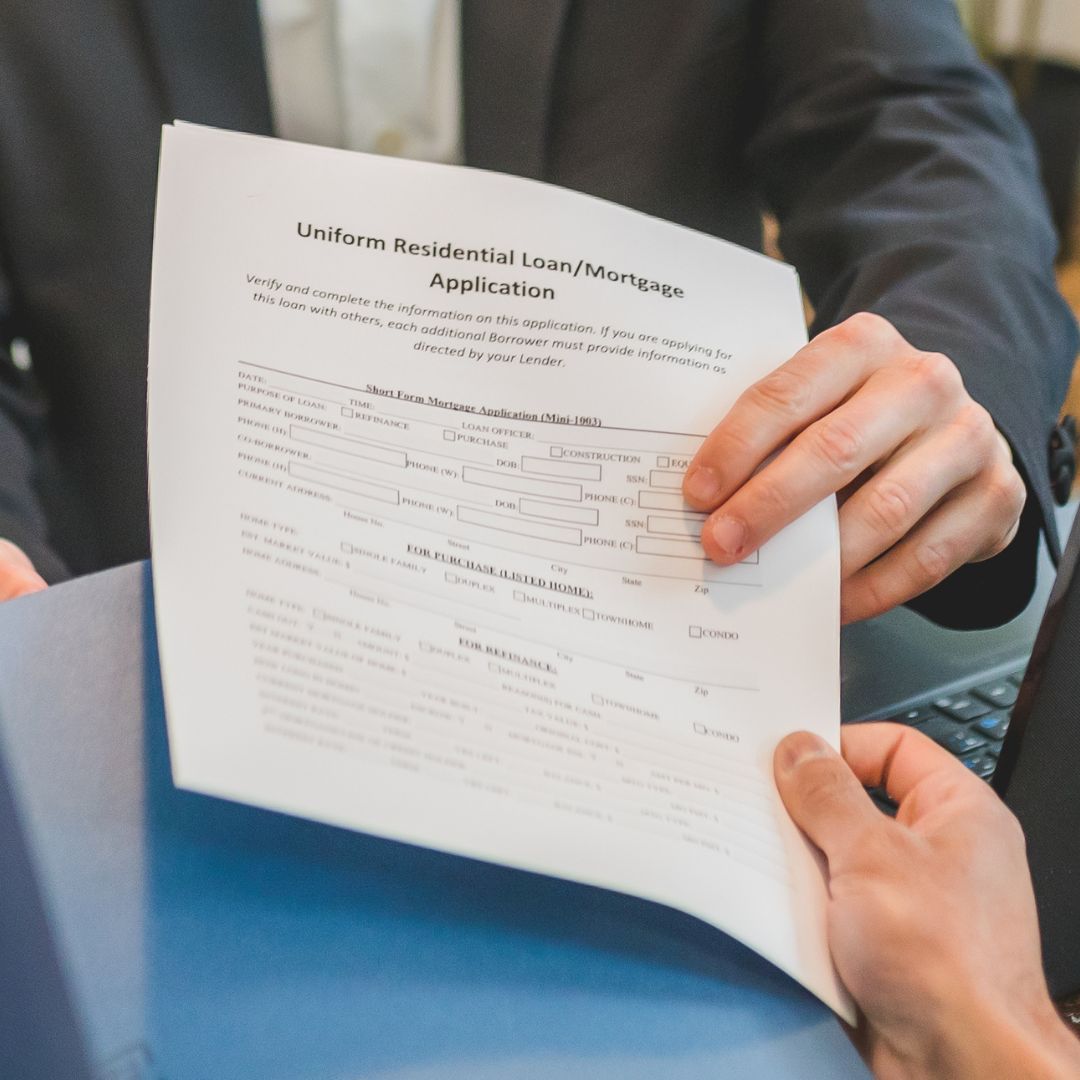

Step 4: Complete the Loan Application

After selecting a lender, you'll need to complete a formal loan application. Be prepared to provide documentation such as income statements, tax returns, and details about your debts. This step is essential for the lender to assess your eligibility and determine the final loan amount.

Navigating the home loan process may seem daunting, but with Home Financing Center’s expert guidance, you can confidently take each step toward securing your mortgage. For personalized assistance and to explore your financing options, contact us today!